Real Estate Capital Gains Tax in Valais: What You Need to Know

27 February 2025

Understanding and Optimizing Real Estate Taxes in Valais

Selling a property in the canton of Valais triggers taxation on the capital gain realized. Understanding how this tax works is essential to optimizing your transaction. This article outlines the specifics of the real estate capital gains tax in Valais, based on official information from the canton.

What Is the Real Estate Capital Gains Tax?

What Is the Real Estate Capital Gains Tax?

The real estate capital gains tax is levied on the profit made from selling a property. This profit is calculated as the difference between the sale price and investment expenses, such as the purchase price and costs associated with property improvements.

In the canton of Valais, this tax is regulated by the cantonal tax law. The real estate capital gains tax is collected by the cantonal authorities, with two-thirds (2/3) of the revenue allocated to the municipality where the property is located. If the property spans multiple municipalities, the taxable gain is distributed proportionally among them.

Calculating the Taxable Gain

Calculating the Taxable Gain

To determine the taxable gain, investment expenses must be deducted from the sale proceeds. These investment expenses include:

• Purchase price: The amount paid for the property, including costs charged to the buyer.

• Improvements and renovations: Expenses related to construction, renovations, and other long-term enhancements that increase the property's value. This also includes capital gains contributions and transaction-related costs, such as brokerage fees and commissions.

• Purchase price: The amount paid for the property, including costs charged to the buyer.

• Improvements and renovations: Expenses related to construction, renovations, and other long-term enhancements that increase the property's value. This also includes capital gains contributions and transaction-related costs, such as brokerage fees and commissions.

It is important to note that expenses previously deducted for income tax purposes or the value of unpaid personal labor cannot be included.

Tax Rates Based on Holding Period

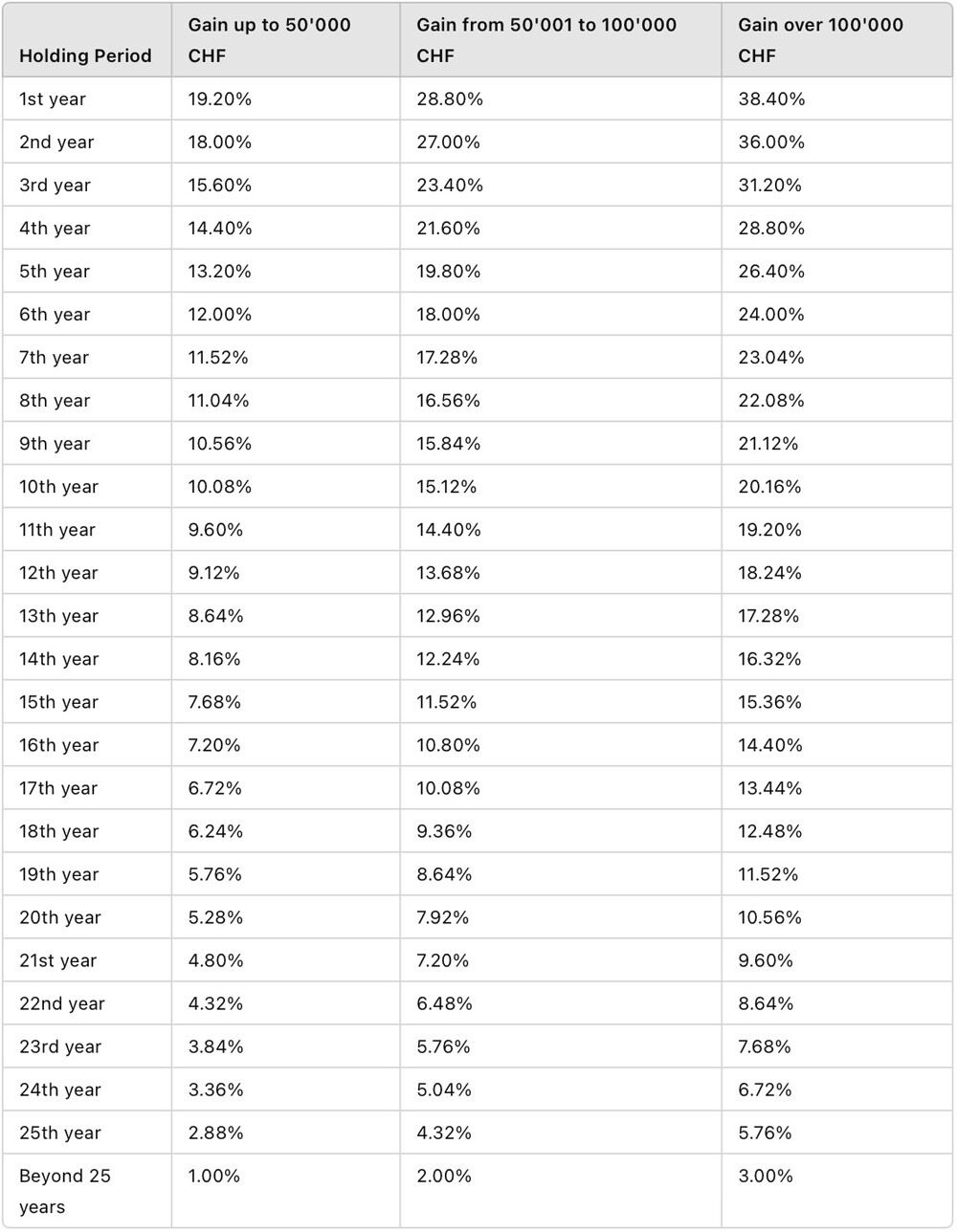

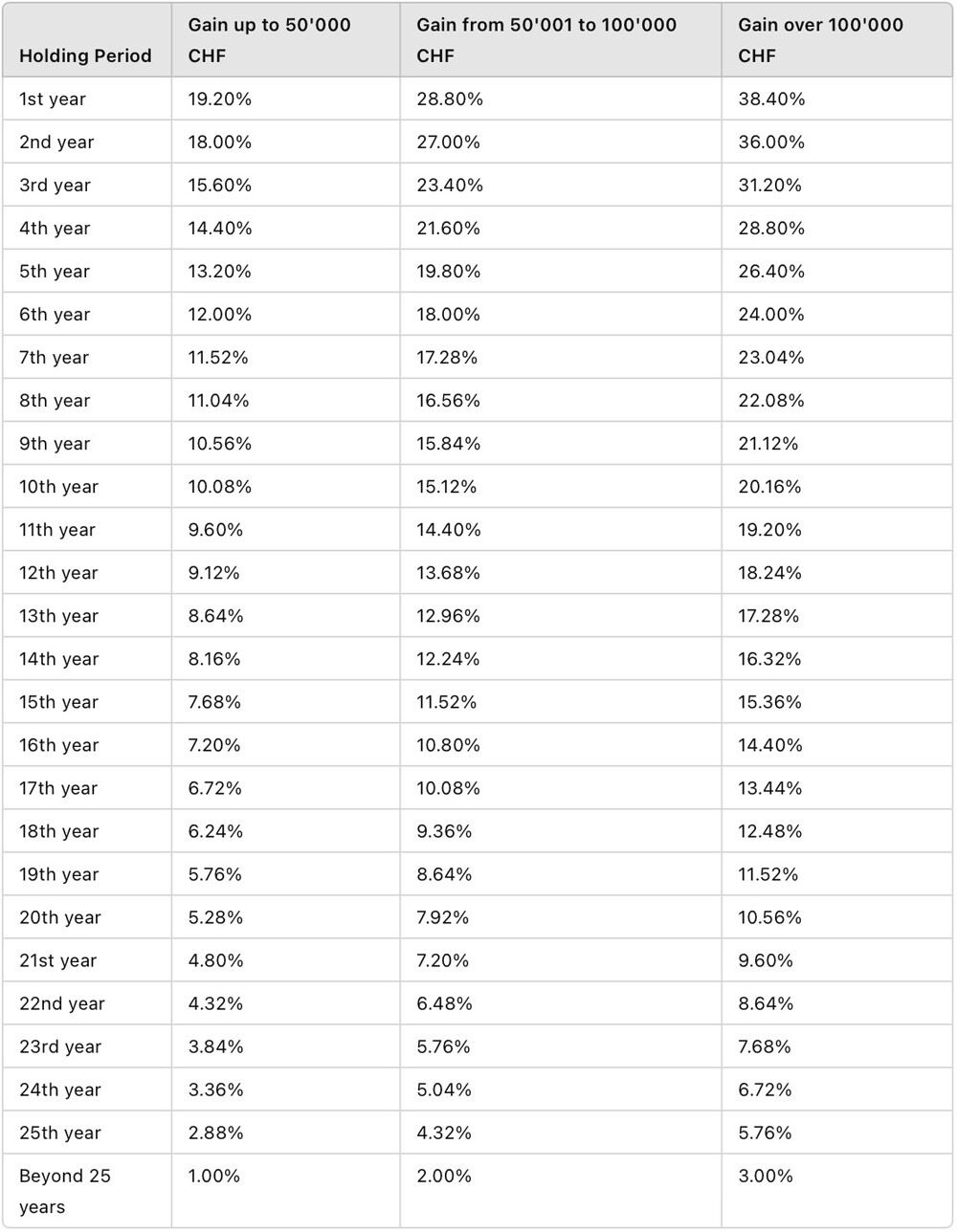

The tax rate varies depending on how long the property has been owned (holding period). The longer you hold the property, the lower the applicable tax rate. Here’s an overview of the current tax rates:

These rates are based on the official Valais cantonal tax document on real estate capital gains taxation.

Deferred Taxation Cases

Deferred Taxation Cases

In certain situations, taxation on the capital gain may be deferred, including:

• Transfer of ownership through inheritance, donation, or between spouses: The tax is postponed until the next taxable sale.

• Transfer of ownership through inheritance, donation, or between spouses: The tax is postponed until the next taxable sale.

• Land consolidation or expropriation: If the proceeds from the sale are reinvested within a reasonable period into a replacement property.

• Sale of a primary residence: If the proceeds are reinvested in purchasing or constructing a new primary residence in Switzerland within an appropriate timeframe.

In Valais, this reinvestment period is two (2) years before or after the sale of the initial property. To qualify for tax deferral, the entire or partial sale proceeds must be reinvested in the new primary home. If only part of the proceeds is reinvested, taxation will apply proportionally to the non-reinvested portion. Additionally, the new property must serve as the taxpayer’s long-term primary residence.

These provisions are detailed in the cantonal tax law.

Useful Documents and Links

Useful Documents and Links

The official website of the State of Valais provides a standardized tax declaration form for real estate capital gains, along with comprehensive information about this tax. An excerpt from the cantonal tax law related to real estate capital gains taxation is also available, as well as an explanatory guide on deferred taxation under Article 46(e) LF.

#Our Real Estate Tips